Contents

hide

Introduction: When trade policies reshape supply chains

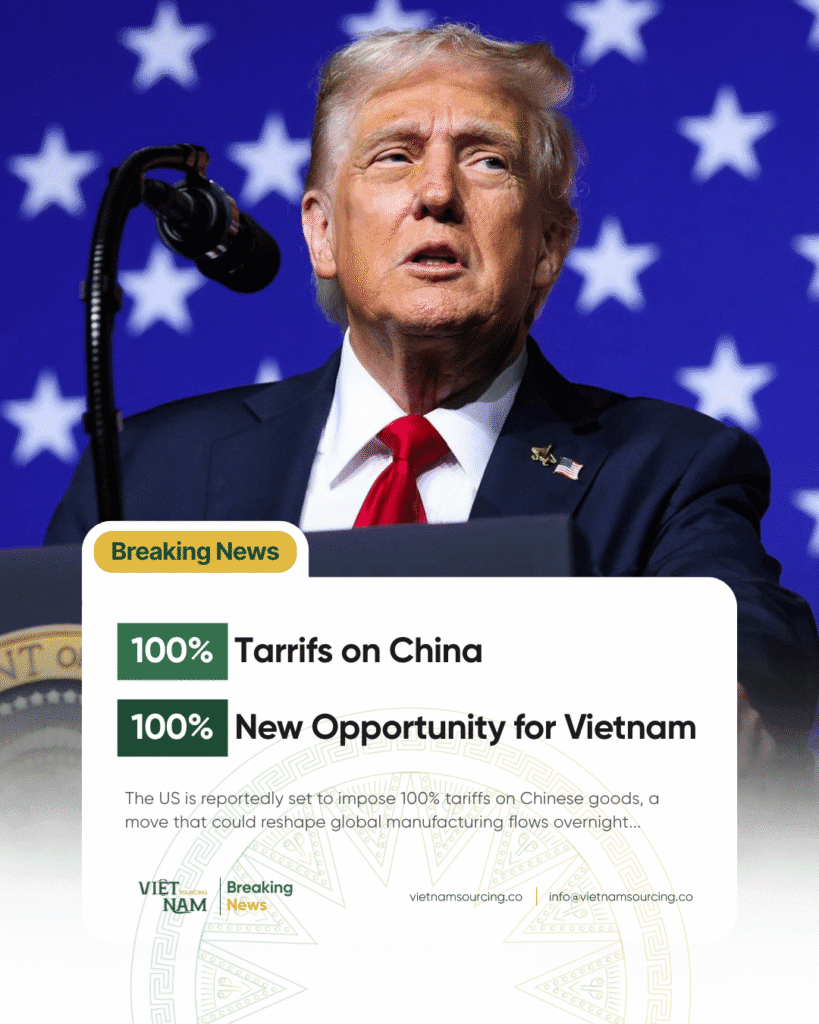

The U.S. government is preparing to impose 100% tariffs on Chinese goods, a move that could instantly rewrite the rules of global manufacturing.

For many international brands, this isn’t just a political headline — it’s a wake-up call.

When the world’s largest exporter faces a cost barrier of that magnitude, companies everywhere must rethink where and how their products are made.

That’s where Vietnam enters the conversation — not as a backup, but as the next logical step in the evolution of global sourcing.

What the 100% tariff means for global trade

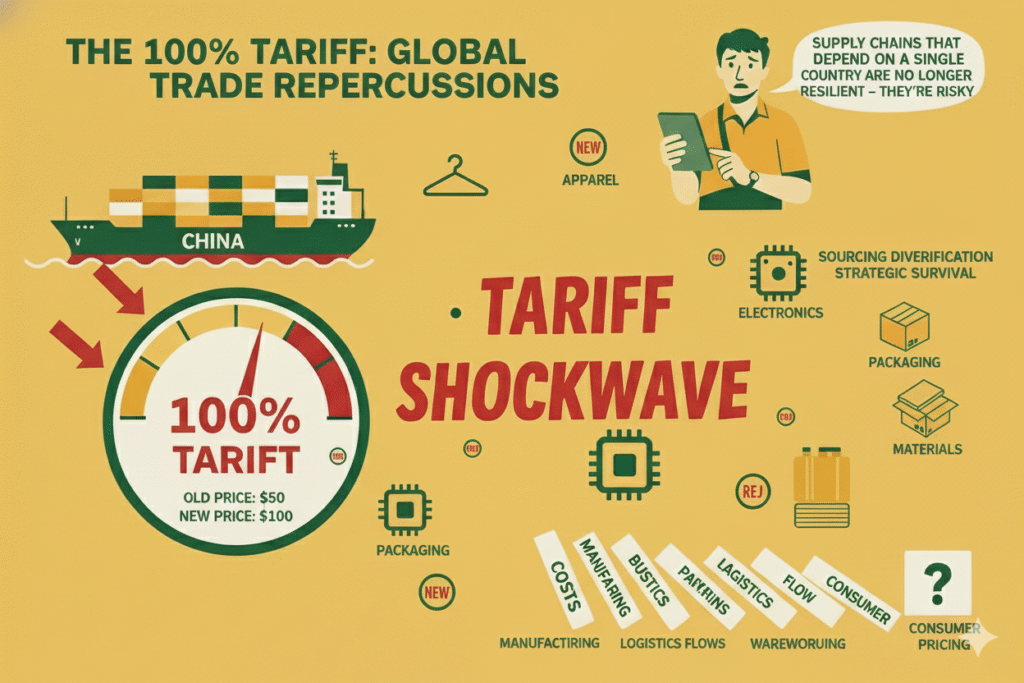

A 100% import tariff doubles the landed cost of goods entering the U.S. from China.

In practice, that means a product currently retailing for $50 could suddenly need to be priced at $100 or brands must absorb the cost themselves.

For companies operating on tight e-commerce margins, this is unsustainable.

That’s why sourcing diversification is no longer optional — it’s strategic survival.

“Supply chains that depend on a single country are no longer resilient — they’re risky,” says a senior sourcing manager for a U.S. retail brand.

This tariff wave will not only affect manufacturing costs but also logistics flows, warehousing, and consumer pricing — creating ripple effects across entire industries, from electronics and apparel to packaging and building materials.

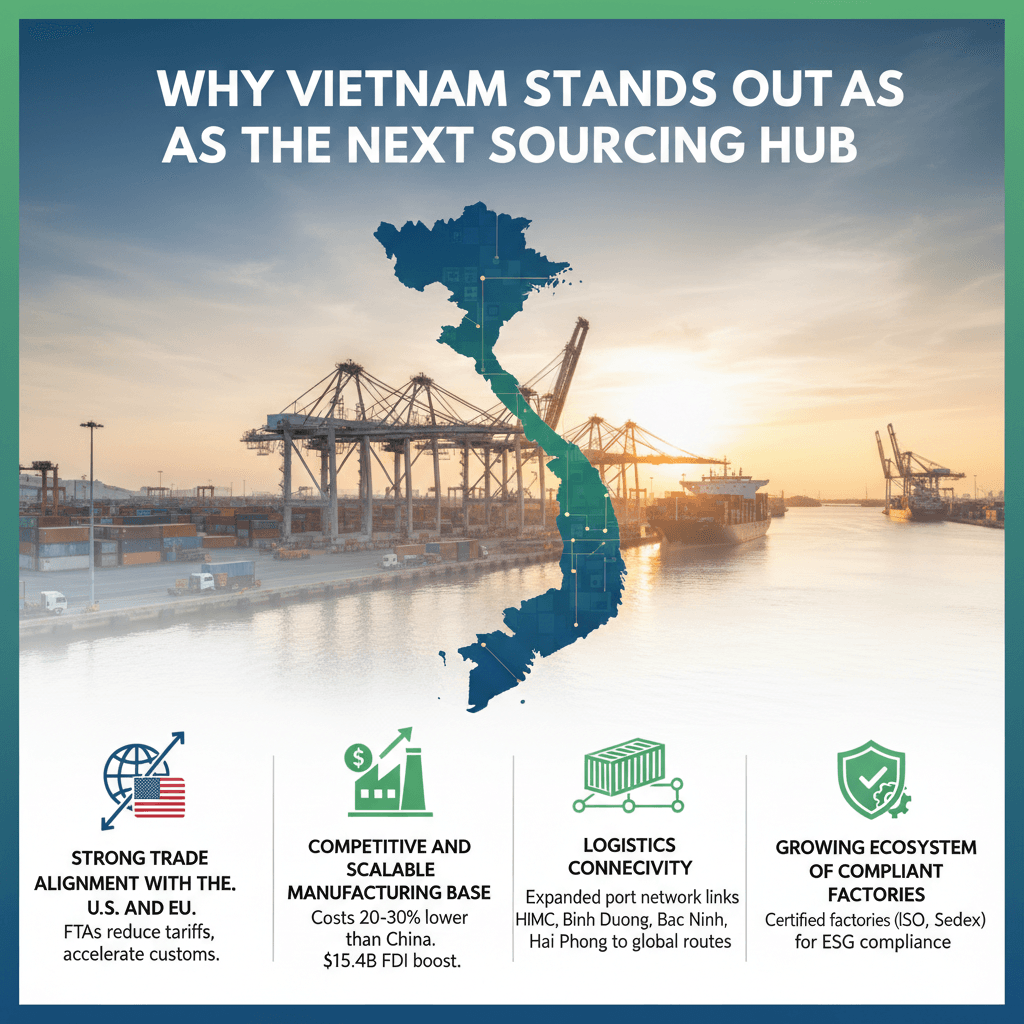

Why Vietnam stands out as the next sourcing hub

Over the past decade, Vietnam has quietly positioned itself as one of Asia’s most agile manufacturing ecosystems.

Now, with this geopolitical shift, it’s stepping into the spotlight.

Here’s why global buyers are turning to Vietnam:

- Strong trade alignment with the U.S. and EU

Vietnam has signed multiple free trade agreements (FTAs), including with the EU, UK, and major Asia-Pacific partners, reducing tariffs and facilitating faster customs clearance.

- Competitive and scalable manufacturing base

Vietnam’s production costs remain 20–30% lower than China’s, while maintaining strong supplier quality.

Recent $15.4 billion in FDI disbursements (the highest in 5 years) is boosting factory capacity in key sectors like furniture, packaging, electronics, and textiles.

- Logistics connectivity

Vietnam’s port and logistics network has expanded significantly, connecting major industrial zones in Ho Chi Minh City, Binh Duong, Bac Ninh, and Hai Phong directly to U.S. and EU trade routes.

- A growing ecosystem of compliant factories

International buyers can now work directly with certified factories that meet standards like ISO, BSCI, and Sedex — critical for ESG compliance and brand reputation.

The hidden opportunity: agility and resilience

When trade shocks happen, some brands react — others evolve.

Vietnam’s strength lies in its ability to adapt quickly. Unlike large-scale manufacturing hubs with rigid structures, Vietnam’s factories are built for flexibility — low to mid-volume runs, fast turnaround, and customizable packaging.

That agility is what modern brands need most.

Whether you’re managing multiple SKUs for an e-commerce catalog or scaling seasonal retail production, responsiveness is the new competitive edge.

At Vietnam Sourcing Co., we call this “agile sourcing” — the ability to pivot suppliers and production methods without losing time or margin.

Case in point: shifting production without disruption

Over the past year, several global brands have quietly begun moving a portion of their production to Vietnam to offset tariff risk.

One U.S. furniture brand, for example, worked with Vietnam Sourcing Co. to transition 40% of their manufacturing within three months — maintaining design consistency, while cutting logistics costs by 18%.

Another packaging supplier in Australia optimized their DIM Weight by redesigning product packaging at the factory level, reducing air freight costs by nearly 25%.

These are not isolated wins — they are signs of a broader transformation in how companies think about supply chain independence.

The mindset shift: from cost-cutting to capacity building

Traditionally, sourcing decisions were made to find the lowest cost.

Today, forward-thinking companies are sourcing to protect business continuity.

Vietnam’s rising FDI inflows and government-backed industrial policies — make it an ideal environment for long-term investment. This isn’t just a short-term fix to a tariff problem; it’s a strategic hedge for the next decade of manufacturing.

By investing in relationships with Vietnamese factories now, brands are effectively buying stability — ensuring they can scale, ship, and sustain growth even when trade policies shift again.

What global buyers should do next

If your supply chain currently relies heavily on China, it’s time to evaluate your risk exposure.

Here’s a practical roadmap:

- Assess tariff impact on your core product categories

- Identify flexible suppliers in Vietnam who can handle both volume and quality

- Build hybrid sourcing models for multi-country diversification

The earlier you begin this transition, the smoother your logistics and cost structures will be once the new tariffs take effect.

Conclusion: From tariffs to transformation

100% tariffs may sound like a crisis — but they’re also a catalyst.

In moments like these, global supply chains don’t collapse; they reinvent themselves.

Vietnam is not waiting on the sidelines. It’s building the next generation of manufacturing — adaptable, export-ready, and globally connected.

For international brands, the opportunity is clear:

Diversify now, and turn uncertainty into long-term resilience.

Ready to explore Vietnam as your next sourcing hub?

Our team at Vietnam Sourcing Co. works directly with certified factories to help brands transition smoothly, reduce costs, and build agile supply chains.